When you apply for a home loan, we need to document that you have enough income to repay the money you are borrowing. If you are self-employed and your income is tricky to document, there are viable mortgage programs that don’t require traditional tax return documents. In the past, you may have heard terms like […]

Getting a Construction Loan to Build or Renovate Your Own Home in NH

There are many reasons you might want to take on a construction project rather than buying an existing home: Maybe you already own the property; or you have a very specific custom home plan in mind; or you want to expand the home you live in and already love. Whatever the reason, our construction loan […]

Mortgage Rates are Rising. Is It Too Late to Refinance?

With mortgage rates going up, I can predict what’s going to happen when I gather with friends and family in the coming months: Someone is going to ask if they still should refinance. Without their mortgage statement on hand, without my fancy financial calculator in my pocket, without food in my stomach, and if I’m […]

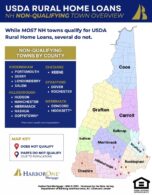

Towns that Qualify for USDA Rural Development Loans in NH

In New Hampshire, there are SO MANY TOWNS that qualify for a USDA rural development loan, it’s far easier to list the towns that don’t qualify. Download the USDA Rural Development Home Loan Eligibility map for a visual on which towns qualify and which towns don’t in New Hampshire. In alphabetical order, the towns that don’t […]

Divorce Mortgage Refinance

Divorcing? Ironically, it is much harder to end a mortgage loan contract than the marital contract. Even if the divorce agreement makes the mortgage your ex-spouse’s responsibility, you are still legally responsible for this debt! The divorce decree is only a legal agreement between you and your ex-spouse, not with your mortgage company. In the […]

New Hampshire VA Loans

Did you serve our country? If you are a veteran of the armed services, reservist, active duty, or surviving spouse of a veteran, then you may be eligible for a VA loan to purchase a new home or refinance your existing home. Why use a VA Loan? That is a good question. There are many […]

Buy a Fixer-Upper with a 203k Loan

If you’ve been thinking of purchasing or refinancing a home that is in need of repairs, the Federal Housing Administration (FHA) 203(k) rehab loan might be for you. There are two types of 203(k) mortgages: streamlined and standard. The streamlined version is for smaller projects and is a less-involved process. Whether it’s for a Purchase or […]

When to Refinance Mortgage

Here are reasons to refinance your mortgage. Lower your monthly payment with a lower interest rate: One of the main reasons homeowners refinance is to lower their monthly payment. Lowering your interest rate by 1% on a $200,000 mortgage can save you $165 per month and more than $55,000 in interest over the life of […]

How to Get Rid of Private Mortgage Insurance (PMI)

What is PMI? Many New Hampshire home buyers make down payments of less than 20 percent and have to pay private mortgage insurance (PMI). PMI is a type of insurance policy that reimburses your lender if you default on your mortgage. Private mortgage insurance charges vary depending on the size of the down payment and […]