Being self-employed brings its own challenges when you’re applying for a mortgage. Mortgage lenders underwrite their loans based on standard guidelines that have been established by Fannie Mae, the FHA, or the VA. Self-employed borrowers are often considered riskier than other types of mortgage loan applicants. Consequently, they frequently receive closer scrutiny than do salaried […]

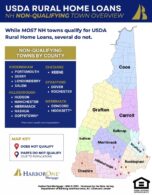

Towns that Qualify for USDA Rural Development Loans in NH

In New Hampshire, there are SO MANY TOWNS that qualify for a USDA rural development loan, it’s far easier to list the towns that don’t qualify. Download the USDA Rural Development Home Loan Eligibility map for a visual on which towns qualify and which towns don’t in New Hampshire. In alphabetical order, the towns that don’t […]

Divorce Mortgage Refinance

Divorcing? Ironically, it is much harder to end a mortgage loan contract than the marital contract. Even if the divorce agreement makes the mortgage your ex-spouse’s responsibility, you are still legally responsible for this debt! The divorce decree is only a legal agreement between you and your ex-spouse, not with your mortgage company. In the […]

New Hampshire VA Loans

Did you serve our country? If you are a veteran of the armed services, reservist, active duty, or surviving spouse of a veteran, then you may be eligible for a VA loan to purchase a new home or refinance your existing home. Why use a VA Loan? That is a good question. There are many […]

Buy a Fixer-Upper with a 203k Loan

If you’ve been thinking of purchasing or refinancing a home that is in need of repairs, the Federal Housing Administration (FHA) 203(k) rehab loan might be for you. There are two types of 203(k) mortgages: streamlined and standard. The streamlined version is for smaller projects and is a less-involved process. Whether it’s for a Purchase or […]

When to Refinance Mortgage

Here are reasons to refinance your mortgage. Lower your monthly payment with a lower interest rate: One of the main reasons homeowners refinance is to lower their monthly payment. Lowering your interest rate by 1% on a $200,000 mortgage can save you $165 per month and more than $55,000 in interest over the life of […]

How to Get Rid of Private Mortgage Insurance (PMI)

What is PMI? Many New Hampshire home buyers make down payments of less than 20 percent and have to pay private mortgage insurance (PMI). PMI is a type of insurance policy that reimburses your lender if you default on your mortgage. Private mortgage insurance charges vary depending on the size of the down payment and […]

First Generation Homeowners: NHHFA Offers Down Payment Assistance – New Program

1stGenHomeNH is a new pilot program from the NHHFA that provides $10,000 down payment assistance to be used towards down payment, closing costs and prepaid escrows on a purchase. The grant functions as a $10,000, 4-year forgivable second mortgage. This program is being offered on a first-come, first-served basis on applications dated after June 1, 2023 […]

VA Loan Limits, Eligibility and Entitlement Explained

In this article we offer some answers and clarifications to common questions about VA home loans in New Hampshire. VA Loan Limits and Purchase Price Limits – What’s the maximum? The VA does not have a maximum loan amount or purchase price limit. You can borrow a million dollars on a VA loan if […]

FHA Loan Limits in NH – 2023

Due to the increase in home prices throughout New Hampshire, the Federal Housing Authority (FHA) has increased its maximum loan amount for 2023 to stay in step with homebuyers who need to finance most of the purchase price. The new loan limits for single-family homes in New Hampshire range from $472,030 to $828,000, depending on […]

Mortgage Documentation Alternatives for Self-Employed, 1099 Employees, and Non-Traditional Income Earners

When you apply for a home loan, we need to document that you have enough income to repay the money you are borrowing. If you are self-employed and your income is tricky to document, there are viable mortgage programs that don’t require traditional tax return documents. In the past, you may have heard terms like […]

How to Qualify for a Jumbo Mortgage in New Hampshire

Jumbo mortgages are greater than the Fannie Mae or Freddie Mac conforming loan size which is $726,200 unless you’re in Rockingham or Strafford Counties where the limits are as high as $828,000 in 2023. Qualifying for a jumbo loan works the same way as a regular conforming loan in the respect that you have to […]

Getting a Construction Loan to Build or Renovate Your Own Home in NH

There are many reasons you might want to take on a construction project rather than buying an existing home: Maybe you already own the property; or you have a very specific custom home plan in mind; or you want to expand the home you live in and already love. Whatever the reason, our construction loan […]

Glimmers of Hope for NH First Time Homebuyers in 2022

It’s no secret that first-time home buyers are facing a limited number of homes to choose from and higher home prices. There are a few glimmers of hope for those who are trying to find and qualify for a mortgage. Eliminate PMI with NHHFA The New Hampshire Housing Finance Authority (NHHFA) has come up with […]

Mortgages for Self Employed in NH

If you’re reading this article, you’re probably self-employed and you need mortgage financing to buy a home in NH. You might be right to think it would be easier to qualify for a mortgage if you worked for someone else and had W2 income. A self-employed borrower might require more documentation than a W2 worker, […]

Getting a Mortgage for a Second Home, Then Renting Out Your First Home

Over the past year, scores of people escaped to rural New Hampshire and ended up buying a second home. And then they rented out their first home back in the city. Can you do that? Can you get a mortgage to buy a second home and then rent out your first home? The answer is, […]

Getting a Mortgage for a Vacation Home When You Plan to Rent it Out

Lots of people call me after vacationing in a cabin in the mountains or a lakeside cottage to explore the possibility of becoming the proud owner of a beautiful vacation home. Let’s face it, the idea that you can list a vacation home on Airbnb or VRBO and get other people to pay for your […]

Mortgage Rates are Rising. Is It Too Late to Refinance?

With mortgage rates going up, I can predict what’s going to happen when I gather with friends and family in the coming months: Someone is going to ask if they still should refinance. Without their mortgage statement on hand, without my fancy financial calculator in my pocket, without food in my stomach, and if I’m […]

Should You Waive a Home Appraisal?

Normally, when purchasing or refinancing a home, your lender is going to require an appraisal of that home. Under certain circumstances, you might be offered an “appraisal waiver,” saving you the cost of the appraisal and the time required to get that appraisal. To get this waiver, Fannie Mae’s or Freddie Mac’s AUS must give […]

Do I Need a Realtor to Buy a House?

The Realtor you sign on with represents YOU, and this comes with many benefits: A Realtor will do the work to search for homes that meet your criteria in current listings and future listings after you have compiled a list of features you would like your home to have. Once you have found a home […]

2019 Loan Limit Increase for Mortgages in NH

The Federal Housing Finance Agency (FHFA) has announced new maximum conforming loan limits for 2019. The new limits set by the FHFA reflect the increase in home prices across the country, making it easier for more borrowers to qualify for financing and achieve the goal of homeownership. New loan limits Baseline maximum conforming loan limits […]

Homebuyer Tax Credit

The Home Start Homebuyer Tax Credit from the New Hampshire Housing Finance Authority (NHHFA) is a money-saving program for first-time homebuyers. This is a federal Mortgage Credit Certificate (MCC) program. If you qualify, and receive a Mortgage Credit Certificate issued through the NHHFA, you can claim a federal tax credit for a portion of the […]

NHHFA Loan Programs

NHHFA, or the New Hampshire Housing Finance Authority, is one of the many resources we can utilize to help homebuyers finance their new home. Many home finance programs require homebuyer education which we can arrange through NHHFA. When you need down payment cash assistance The Home Flex Plus program from NHHFA provides cash assistance for […]

How to Qualify for a Larger Mortgage in New Hampshire

You may have an idea of what a “large” mortgage means to you, but in the mortgage world, we have something called “jumbo” mortgages. These are mortgages that are so large, they are greater than the Fannie Mae or Freddie Mac conforming loan size which is normally $453,100 unless you’re in Rockingham or Strafford Counties […]

Realtor and Mortgage Lender Relationships

When Realtors© and mortgage lenders have a good relationship, transactions go smoothly. We have cultivated incredible working relationships with some of the best Realtors© in NH. Far too often we’ve heard horror stories from Realtors that have stemmed from poor working relationships with mortgage lenders. For example, a homebuyer’s financing gets delayed and they have […]

Cash Out Refinancing

If you’d like to tap into the equity in your home to Invest in home improvements Make a major purchase or Consolidate credit card bills, student loans or other debt you might consider a cash out refinance program that provides you with cash from your home equity at closing. The process of refinancing is similar […]