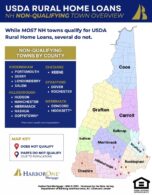

In New Hampshire, there are SO MANY TOWNS that qualify for a USDA rural development loan, it’s far easier to list the towns that don’t qualify.

Download the USDA Rural Development Home Loan Eligibility map for a visual on which towns qualify and which towns don’t in New Hampshire.

In alphabetical order, the towns that don’t qualify are:

Concord

Derry

Dover

Hudson

Keene

Londonderry

Manchester

Merrimack

Nashua

Portsmouth

Rochester

Salem

…and parts of Goffstown and Hooksett due to population.

Let me give you some rules of thumb: Densely populated areas from the Massachusetts border to Hooksett via Route 93 or Route 3 Everett Turnpike. There are a few other large towns like Hudson, Concord, Portsmouth, Dover, Keene, and Rochester that are also ineligible. Hooksett and Goffstown are the two outliers where some part of each town is eligible and other parts of the town are ineligible for the USDA rural development program.

Here is a link to the USDA’s website where you can search to see if a property you are interested in is eligible for an RD loan. http://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do

There are other factors that affect if you are eligible for an RD loan besides location, such as your income. If you have questions about income limits, property eligibility, how much you qualify for, or if you’re wondering if this option is right for you, please email me.