Jumbo mortgages are greater than the Fannie Mae or Freddie Mac conforming loan size which is $726,200 unless you’re in Rockingham or Strafford Counties where the limits are as high as $828,000 in 2023. Qualifying for a jumbo loan works the same way as a regular conforming loan in the respect that you have to […]

How to Qualify for a Larger Mortgage in New Hampshire

You may have an idea of what a “large” mortgage means to you, but in the mortgage world, we have something called “jumbo” mortgages. These are mortgages that are so large, they are greater than the Fannie Mae or Freddie Mac conforming loan size which is normally $453,100 unless you’re in Rockingham or Strafford Counties […]

Realtor and Mortgage Lender Relationships

When Realtors© and mortgage lenders have a good relationship, transactions go smoothly. We have cultivated incredible working relationships with some of the best Realtors© in NH. Far too often we’ve heard horror stories from Realtors that have stemmed from poor working relationships with mortgage lenders. For example, a homebuyer’s financing gets delayed and they have […]

Charley Farley Home Loans Commercials

This year we unveiled some new Charley Farley Home Loans commercials, now airing on WMUR-TV. We’re happy with the positive feedback from viewers! For first time homebuyers: For those wondering how much home they’ll qualify for: For current homeowners planning to upsize to a larger home: For busy folks who want to […]

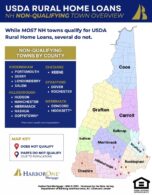

Towns that Qualify for USDA Rural Development Loans in NH

In New Hampshire, there are SO MANY TOWNS that qualify for a USDA rural development loan, it’s far easier to list the towns that don’t qualify. Download the USDA Rural Development Home Loan Eligibility map for a visual on which towns qualify and which towns don’t in New Hampshire. In alphabetical order, the towns that don’t […]