1stGenHomeNH is a new pilot program from the NHHFA that provides $10,000 down payment assistance to be used towards down payment, closing costs and prepaid escrows on a purchase. The grant functions as a $10,000, 4-year forgivable second mortgage. This program is being offered on a first-come, first-served basis on applications dated after June 1, 2023 […]

Glimmers of Hope for NH First Time Homebuyers in 2022

It’s no secret that first-time home buyers are facing a limited number of homes to choose from and higher home prices. There are a few glimmers of hope for those who are trying to find and qualify for a mortgage. Eliminate PMI with NHHFA The New Hampshire Housing Finance Authority (NHHFA) has come up with […]

Homebuyer Tax Credit

The Home Start Homebuyer Tax Credit from the New Hampshire Housing Finance Authority (NHHFA) is a money-saving program for first-time homebuyers. This is a federal Mortgage Credit Certificate (MCC) program. If you qualify, and receive a Mortgage Credit Certificate issued through the NHHFA, you can claim a federal tax credit for a portion of the […]

NHHFA Loan Programs

NHHFA, or the New Hampshire Housing Finance Authority, is one of the many resources we can utilize to help homebuyers finance their new home. Many home finance programs require homebuyer education which we can arrange through NHHFA. When you need down payment cash assistance The Home Flex Plus program from NHHFA provides cash assistance for […]

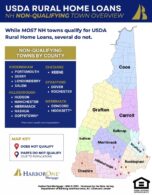

Towns that Qualify for USDA Rural Development Loans in NH

In New Hampshire, there are SO MANY TOWNS that qualify for a USDA rural development loan, it’s far easier to list the towns that don’t qualify. Download the USDA Rural Development Home Loan Eligibility map for a visual on which towns qualify and which towns don’t in New Hampshire. In alphabetical order, the towns that don’t […]

New Hampshire VA Loans

Did you serve our country? If you are a veteran of the armed services, reservist, active duty, or surviving spouse of a veteran, then you may be eligible for a VA loan to purchase a new home or refinance your existing home. Why use a VA Loan? That is a good question. There are many […]

Conventional vs. FHA Loans

The mortgage industry can be a confusing maze when trying to determine how much you qualify for, how much cash you need, and how to get the lowest monthly payment. The two largest families of loan programs are Conventional and FHA programs. To keep things simple, here is a list of the primary benefits to […]

Home Improvement Loans

Do you love your home but need some major repairs? Do you want to update a certain room in your home? Do you want to put an addition on your home to give you and your family a little more room? Is your dream home a fixer upper? These are just a few of the […]

New Hampshire Home Loans

There are many different loan programs offered here in New Hampshire. Start here to make your dreams of home ownership a reality! 10 Easy Steps to Buying a Home in New Hampshire There are so many questions that need to be answered when buying a home, especially if you are a first-time home buyer. Where […]

0 Down Home Loan Programs

If you are a First Time Home Buyer or want to buy a home with little or no money down, here are a few mortgage programs available to choose from in New Hampshire. Rural Development Loan (RD Loan) program from The US Department of Agriculture The USDA offers a program called the RD or Rural […]

Conventional Loans vs. FHA Loans

If you’re looking to buy your first home, there are a number of things you need to know about a down payment and mortgage insurance. First, you’ll likely have to obtain a conventional or a Government loan like the Federal Housing Administration (FHA) mortgage, or a $0 down RD loan through the USDA. Let’s compare a Conventional loan […]

When to Buy a Home in NH

5 Reasons to Buy a Home Right Now! Buying right is the first step to profit and success but some potential buyers have been afraid to act. If you have been sitting on the sideline waiting for the next buying opportunity, here are 5 reasons why now might be the time to take the […]

The 3 Things You Need to Know About Home Mortgage Insurance

When buying a home it’s important to understand the basics of mortgage insurance. What is it? How does it work? What does it mean to you as a home buyer or homeowner? Below are 3 things you need to know. Mortgage insurance is taken out by the lender to provide protection against you defaulting on […]

What to Expect in a Short Sale or Foreclosure

Short sales and foreclosures are facts of life in the real estate market these days. There is a good chance, then, that agents and clients will encounter them when they go to purchase a home or investment property. Short Sale Short sale means that the lender on that property wants to sell it and is going […]

Getting to Know Fannie and Freddie

In a nutshell, Fannie Mae and Freddie Mac are intermediaries. They buy loans from lenders and then turn around and sell them to investors. Most mortgages, regardless of the type, are originated with the expectation that they will be sold after they close. Loans that are kept in-house are called portfolio loans. These loans are […]