The Home Start Homebuyer Tax Credit from the New Hampshire Housing Finance Authority (NHHFA) is a money-saving program for first-time homebuyers. This is a federal Mortgage Credit Certificate (MCC) program. If you qualify, and receive a Mortgage Credit Certificate issued through the NHHFA, you can claim a federal tax credit for a portion of the mortgage interest paid per year as long as you live in the home. Here’s how the MCC program can make home ownership more affordable:

- The tax credit gives you more take-home pay, so you can offset monthly mortgage payments.

- Saves you up to $2,000 a year for the life of your loan.

- Helps you potentially qualify for a higher priced home.

Program Qualifications

- First-time homebuyer: No ownership within past three years, or buy in a targeted community.

- Government-insured mortgage or eligible for sale to Fannie or Freddie: Usually a fixed rate.

- Must be owner occupied: This program is not for landlords.

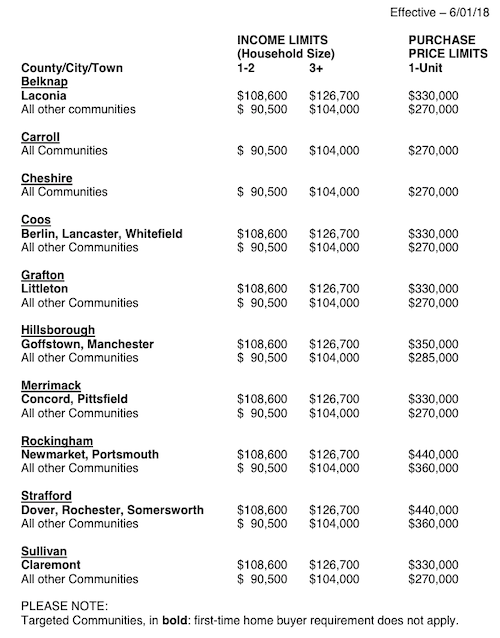

- Meet income and purchase price limits as noted.

- Complete a homebuyer education course online. It’s not difficult, but everyone has to do it.

If you think you may qualify, get the process started by filling out the brief form here or call us at 603-471-9300. We’ll keep your information completely private.

Here are the income and purchase price limits.