This year we unveiled some new Charley Farley Home Loans commercials, now airing on WMUR-TV. We’re happy with the positive feedback from viewers! For first time homebuyers: For those wondering how much home they’ll qualify for: For current homeowners planning to upsize to a larger home: For busy folks who want to […]

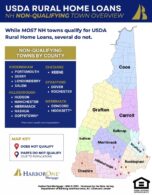

Towns that Qualify for USDA Rural Development Loans in NH

In New Hampshire, there are SO MANY TOWNS that qualify for a USDA rural development loan, it’s far easier to list the towns that don’t qualify. Download the USDA Rural Development Home Loan Eligibility map for a visual on which towns qualify and which towns don’t in New Hampshire. In alphabetical order, the towns that don’t […]

Divorce Mortgage Refinance

Divorcing? Ironically, it is much harder to end a mortgage loan contract than the marital contract. Even if the divorce agreement makes the mortgage your ex-spouse’s responsibility, you are still legally responsible for this debt! The divorce decree is only a legal agreement between you and your ex-spouse, not with your mortgage company. In the […]

New Hampshire VA Loans

Did you serve our country? If you are a veteran of the armed services, reservist, active duty, or surviving spouse of a veteran, then you may be eligible for a VA loan to purchase a new home or refinance your existing home. Why use a VA Loan? That is a good question. There are many […]

Vacation Home Loans

Do you dream of waking up in your own home overlooking a mountain or a beautiful lake? If your dream vacation home is in New Hampshire, we can help make it affordable for you with low, fixed rate vacation home loans. We finance a variety of second home types like condominiums, single-family homes and three-season […]

Conventional vs. FHA Loans

The mortgage industry can be a confusing maze when trying to determine how much you qualify for, how much cash you need, and how to get the lowest monthly payment. The two largest families of loan programs are Conventional and FHA programs. To keep things simple, here is a list of the primary benefits to […]

Home Improvement Loans

Do you love your home but need some major repairs? Do you want to update a certain room in your home? Do you want to put an addition on your home to give you and your family a little more room? Is your dream home a fixer upper? These are just a few of the […]

Mortgage Rates in NH

One of the most common questions everyone has when financing a home, whether it is for refinancing or purchasing, is what is my interest rate going to be? It’s a fair and simple enough question with many possible answers. There are many factors that go into determining what your interest rate will be on your […]

New Hampshire Home Loans

There are many different loan programs offered here in New Hampshire. Start here to make your dreams of home ownership a reality! 10 Easy Steps to Buying a Home in New Hampshire There are so many questions that need to be answered when buying a home, especially if you are a first-time home buyer. Where […]

0 Down Home Loan Programs

If you are a First Time Home Buyer or want to buy a home with little or no money down, here are a few mortgage programs available to choose from in New Hampshire. Rural Development Loan (RD Loan) program from The US Department of Agriculture The USDA offers a program called the RD or Rural […]

Buying Investment Property

With a strong rental market and historically low mortgage rates, the opportunities for purchasing rental properties in the current market are unprecedented. You can purchase an investment property for one of two reasons. The first is to repair and then resell the property. The second is to rent out the property for the income stream – […]

Buy a Fixer-Upper with a 203k Loan

If you’ve been thinking of purchasing or refinancing a home that is in need of repairs, the Federal Housing Administration (FHA) 203(k) rehab loan might be for you. There are two types of 203(k) mortgages: streamlined and standard. The streamlined version is for smaller projects and is a less-involved process. Whether it’s for a Purchase or […]

4 Ways to Instantly Increase the Value (and Price) of Your Home in NH

Want to instantly add value to your home AND get at or above your asking price? Just follow these 4 simple tips.

Thinking About Refinancing?

Thinking about Refinancing? Just 5 Minutes Could Save you a Bundle! One of the best reasons to refinance your mortgage is to obtain a lower interest rate and a lower monthly payment. By refinancing, you will payoff off your existing mortgage and replace it with a new one. This can often be accomplished with […]

Conventional Loans vs. FHA Loans

If you’re looking to buy your first home, there are a number of things you need to know about a down payment and mortgage insurance. First, you’ll likely have to obtain a conventional or a Government loan like the Federal Housing Administration (FHA) mortgage, or a $0 down RD loan through the USDA. Let’s compare a Conventional loan […]

When to Buy a Home in NH

5 Reasons to Buy a Home Right Now! Buying right is the first step to profit and success but some potential buyers have been afraid to act. If you have been sitting on the sideline waiting for the next buying opportunity, here are 5 reasons why now might be the time to take the […]

The 3 Things You Need to Know About Home Mortgage Insurance

When buying a home it’s important to understand the basics of mortgage insurance. What is it? How does it work? What does it mean to you as a home buyer or homeowner? Below are 3 things you need to know. Mortgage insurance is taken out by the lender to provide protection against you defaulting on […]

What to Expect in a Short Sale or Foreclosure

Short sales and foreclosures are facts of life in the real estate market these days. There is a good chance, then, that agents and clients will encounter them when they go to purchase a home or investment property. Short Sale Short sale means that the lender on that property wants to sell it and is going […]

Buying a Home? The 3 MUSTs of Getting a Home Inspection!

While home buyers typically think of home inspections as being required solely for the purchase of homes that are in a state of needing repair, the truth is that they benefit all types of buyers. If there is a problem with the property that the seller either is attempting to hide or is truly unaware […]